bir form 1701q download|bir form 1701q excel format : Cebu BIR Form No. 1927. Download | | s40 Requirements Application and Joint .

Welcome To OICP eCTPL System - CTAF Let's Get Started. OICP - CTPL Tax Adjustment Facility OICP eCTPL System - CTAF

bir form 1701q download,Download BIR Form No. 1701Q for quarterly income tax return for individuals earning income from business or profession. Find other BIR forms, revenue issuances, and tax .

The tax rates and nature of income payments subject to final withholding .For EWT - This Certificate in turn should be attached to the Quarterly/Annual Income .

BIR Form No. 2119. Download. Voluntary Assessment and Payment Program .

BIR Form No. 1945. Download. Application for Certificate of Tax Exemption for .BIR Form No. 1927. Download | | s40 Requirements Application and Joint .For “with payment” ITRs (BIR Form Nos. 1700 / 1701 / 1701Q / 1702 / 1702Q / .

BIR Form No. 2551Q. Download / Quarterly Percentage Tax Return. Description. .BIR Form No. 2000-OT. Download | Documentary Stamp Tax .I declare under the penalties of perjury, that this annual return has been made in good faith, verified by me, and to the best of my knowledge and belief, is true and correct, pursuant .BIR Form No. 1701Q July 2008(ENCS) For Self-Employed Individuals, Estates, and Trusts (Including those with both Business & Compensation Income) . 38K/L Other Payment/s .The eBIRForms is a package application covering thirty-six (36) BIR Forms comprised of Income Tax Returns; Excise Tax Forms; VAT Forms; Withholding Tax Forms; .

Reports/Forms for Submission by Registered Taxpayers. SAWT (Summary Alphalist of Withholding Tax) - through eSubmission when claiming Creditable Withholding Tax upon .

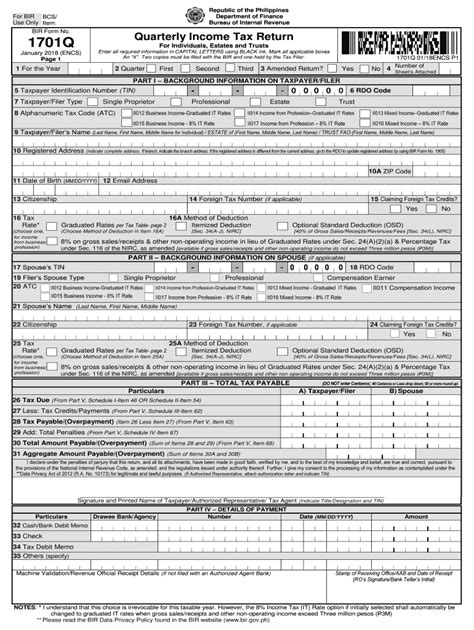

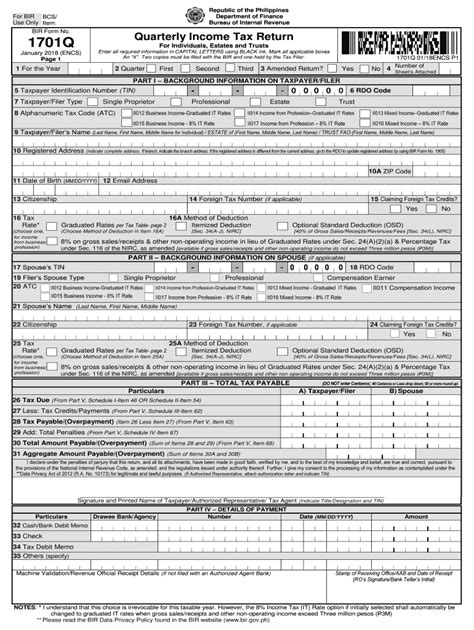

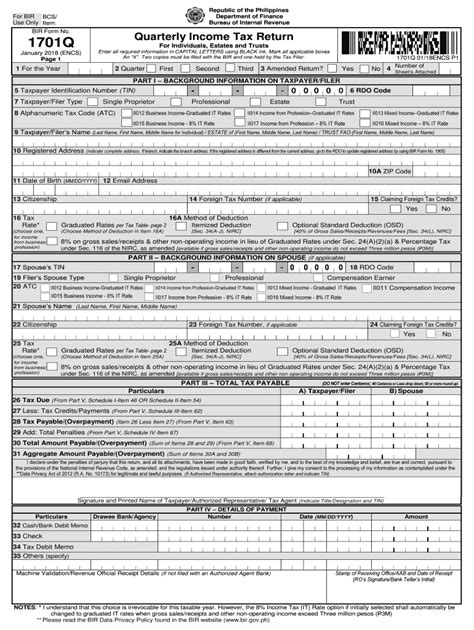

1701Q 01/18ENCS P2. TIN. Taxpayer/Filer's Last Name. - - -. PART V – COMPUTATION OF TAX DUE (DO NOT enter Centavos; 49 Centavos or Less drop down; 50 or more .

We would like to show you a description here but the site won’t allow us.

Learn how to file BIR Form 1701Q, a Quarterly Income Tax Return for individuals, estates, and trusts in the Philippines. Find out who is required to file, how to .BIR Form 1701Q - Quarterly Income Tax Return. GUIDELINES AND INSTRUCTIONS. Who Shall File. This return shall be filed in triplicate by the following individuals .Guidelines and Instructions for BIR Form No. 1701Q [January 2018 (ENCS)] Quarterly Income Tax Return for Individuals, Estates and Trusts . Who Shall File. This return shall .

Make the most of the BIR 1701Q form download option for offline completion, or complete the form online via PDFLiner. Fill in essential information, including name, TIN (Tax Identification Number), RDO (Revenue District Office) code, and the applicable taxable quarter. Accurately report all income earned during the quarter, including .bir form 1701q excel formatFacts on Certificate 2307 and Form 1701Q. 1) A resident citizen engaged in trade, business, or practice of profession within (or not within) the Philippines. 2) A resident alien, non-resident citizen or non-resident .

For “with payment” ITRs (BIR Form Nos. 1700 / 1701 / 1701Q / 1702 / 1702Q / 1704) File the return in triplicate (two copies for the BIR and one copy for the taxpayer) with the Authorized Agent Bank (AAB) of the place where taxpayer is registered or .Reports/Forms for Submission by Registered Taxpayers. SAWT (Summary Alphalist of Withholding Tax) - through eSubmission when claiming Creditable Withholding Tax upon filing of: 1701, 1701A, 1701Q, 2550M, 2550Q & 2551Q SLSP (Summary List of Sales and Purchases) - through eSubmission as attachment to 2550Q (RMO No. 4-2003) 0619E .bir form 1701q download bir form 1701q excel formatP 125,000 + 32% of the excess over P 500,000. BIR Form 1701Q - Quarterly Income Tax Return. Guidelines and Instructions. Who Shall File. This return shall be filed in triplicate by the following individuals. regardless of amount of gross income: 1) A resident citizen engaged in trade, business, or practice of.We would like to show you a description here but the site won’t allow us.This form, together with all the necessary documents, shall be submitted every time a tax treaty application or request for confirmation is filed with the International Tax Affairs Division (ITAD) of the Bureau of Internal Revenue. BIR Form No. 1914. Download. (PDF) Application for Tax Credits/Refunds.BIR Form 1701 PDF Download. If you need an editable PDF file for this BIR form, you can it in this link BIR Form 1701 Editable PDF. Completing a BIR form is a daunting task that is why we built a software to automate this and weve been using it since 2012. You can also use this tool for your taxes to save time and so you can focus on more . BIR Form No. 1701Q now available. The form was revised due to the implementation of the Tax Reform for Acceleration and Inclusion Law. Taxpayers must use the newly revised return in filing and paying the quarterly income tax return beginning the first quarter of 2018. Manual filers must download the PDF version of the return, which .

Download Free PDF. Download Free PDF. BIR FORM 1701Q. BIR FORM 1701Q. jowie arepentido. See Full PDF Download PDF. See Full PDF Download PDF. Related Papers. HAL (Le Centre pour la Communication Scientifique Directe) . (RO's Signature/ Bank Teller's Initial BIR FORM 1701Q (ENCS)-PAGE 2 TAX TABLE If TAXABLE INCOME is: .

II. Generating 1701Q Reports. Step 1: Go to your dashboard > Income Tax Return> Choose the 1701Q tab then click the Generate Report (+) to continue. This dialogue box will appear, click “Accept and Continue”. Step 2: Select the year, as well as the appropriate quarter for the return > Click Generate button. III. Tax Rate Option.01. Edit your 1701q bir form online. Type text, add images, blackout confidential details, add comments, highlights and more. 02. Sign it in a few clicks. Draw your signature, type it, upload its image, or use your .Annual Income Tax Return Page 5 - Schedules 1 to 4A BIR Form No. 1701 June 2013 (ENCS) 170106/13ENCSP5 TIN Tax Filer’s Last Name 0 0 0 0 SCHEDULES-REGULAR RATE Schedule 1 - Gross Compensation Income and Tax Withheld (Attach additional sheet/s, if necessary) Gross Compensation Income and Tax Withheld (On Items 1, 2 & .Two copies MUST be filed with the BIR and one held by the Tax Filer. BIR Form No. 1701. July 2013 (ENCS) Page 1. 1 For the year. 01 - January 02 - February 03 - March 04 - April 05 - May 06 - June 07 - July 08 - August 09 - September 10 - October 11 - November 12 - December. / 20.

This Certificate should be attached to the Annual Income Tax Return - BIR Form 1701 for individuals, or BIR Form 1702 for non-individuals. Filing Date. Payor must furnish the payee on or before January 31 of the year following the year in which the income payment was made. BIR Form No. 2306. Download. ( Excel) | ( PDF) Certificate of Final Tax .bir form 1701q downloadThis Certificate should be attached to the Annual Income Tax Return - BIR Form 1701 for individuals, or BIR Form 1702 for non-individuals. Filing Date. Payor must furnish the payee on or before January 31 of the year following the year in which the income payment was made. BIR Form No. 2306. Download. ( Excel) | ( PDF) Certificate of Final Tax .VAT/Percentage Tax Returns. BIR Form No. 2550M. Download. (Zipped Excel) Monthly Value-Added Tax Declaration. Description. This return/declaration shall be filed in triplicate by the following taxpayers; A VAT-registered person; and. A person required to register as a VAT taxpayer but failed to register.How to fill out bir forms download 2018-2024. 01. First, download the BIR forms from the official website of the Bureau of Internal Revenue (BIR). This can usually be done by navigating to the BIR's website and searching for the specific form you need. 02.

The BIR Form 1701Q is a Quarterly Income Tax Return for individuals, estates, and trusts, including those with mixed-income (i.e., compensation and income from business/ profession ). It’s used by the Bureau of Internal Revenue (BIR) in the Philippines to record the income tax liability of a taxpayer each quarter.

bir form 1701q download|bir form 1701q excel format

PH0 · tax refund philippines computation

PH1 · how to compute 1701q

PH2 · bir form 1702 rt download

PH3 · bir form 1701q excel format

PH4 · bir form 1701 excel file

PH5 · bir 1700 form download

PH6 · Iba pa

PH7 · 1701q bir form pdf

PH8 · 1701 bir forms philippines